Irs Vehicle Depreciations Schedule For 2024 – The IRS has announced the annual inflation adjustments for the year 2024, including tax rate schedules, tax tables and cost-of-living adjustments. . While the Internal Revenue Service has not yet announced the 2024 adjustment of tax brackets due to annual inflation, that could be coming in the next few days as noted by Steve Grodnitzky of .

Irs Vehicle Depreciations Schedule For 2024

Source : www.irs.gov

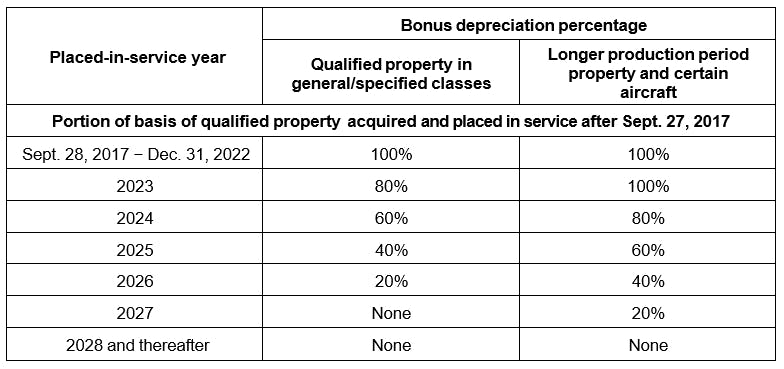

Bonus depreciation rules, recovery periods for real property and

Source : www.bakertilly.com

Accounting & Tax Guides | KraftCPAs Nashville Accounting Firm

Source : www.kraftcpas.com

News | Depreciation Guru

Source : www.depreciationguru.com

Claim Car Depreciation from the IRS See How To Calculate Your

Source : www.driversnote.com

EWH Small Business Accounting | Waukesha WI

Source : www.facebook.com

Claiming Section 179 | Chevy Dealer Near White Plains, NY

Source : www.mtkiscochevrolet.com

2024 IRS Mileage Rate: What Businesses Need to Know

Source : www.motus.com

Publication 946 (2022), How To Depreciate Property | Internal

Source : www.irs.gov

Luxury Vehicle Business Tax Depreciation Advantage | Land Rover

Source : www.landroverraleigh.com

Irs Vehicle Depreciations Schedule For 2024 Publication 946 (2022), How To Depreciate Property | Internal : The tax agency hasn’t yet announced the new brackets for 2024, but that is likely to come within the next days or weeks, according to Steve Grodnitzky of Bloomberg Tax, which has issued its own . With the inflation Reduction Act, qualifying taxpayers will be eligible for substantial tax credits on clean energy vehicles starting in 2024. The IRS has proposed allowing eligible taxpayers to .

.svg)